Business in Malta: registration, licenses and tax incentives discussed at the UNBA

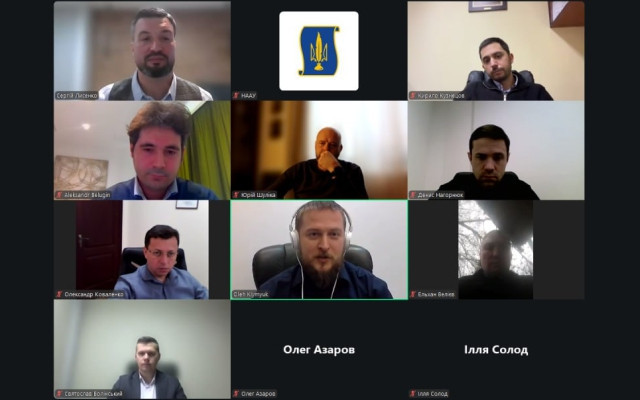

The Republic of Malta remains one of the most attractive jurisdictions in the European Union for investment. Opportunities for establishing and developing a business in this country were discussed by participants at a round table organized by the UNBA Committee on business and investor protection.

Serhii Lysenko, the moderator of the event, deputy chairman of the Committee, outlined the theme of the event — the practical aspects of business registration in Malta, tax regulation, tax incentives, and state support instruments for entrepreneurship.

Speaking about Malta as a jurisdiction for business Oleg Klymyuk, assistant to the Honorary Consul of the Republic of Malta in Kyiv, emphasized the possibility of quickly establishing a legal entity and, in some cases, operating at reduced tax rates for non-residents — from 0% to 5%. He also highlighted opportunities for the IT sector: visas for employees and «digital nomads», as well as tax breaks for companies.

As an example of relocation, he cited a 2016 case: the company behind a computer game franchise moved 75 employees from Kyiv to Malta and, in one week, obtained visas and established a legal entity.

O. Klymyuk named the cryptocurrency sector as another area of focus, emphasizing that Malta has implemented EU requirements and legalized cryptocurrencies, positioning itself as one of the «crypto-friendly» jurisdictions in the European Union. He also mentioned the dynamic real estate market and its growth potential, describing Malta as a «window to Africa» and explaining that Maltese banks and legal entities had made individual purchases for African countries, including spare parts for Antonov aircraft prior to the full-scale invasion.

The keynote speaker at the event was Alexander Belugin, an advocate at the Maltese law firm WH Partners, which operates in six countries around the world.

Describing Malta, he emphasized that it is an EU jurisdiction with a stable economy and two official languages — Maltese and English. At the same time, government agencies communicate in English, which reduces the language barrier for international clients.

The speaker outlined the key sectors of the economy, including financial services (banks, payment institutions, processing), online gambling, fintech startups, the crypto industry, and tourism. The speaker also mentioned business support and incentive programs implemented through Malta Enterprise: grants and tax credits for startups, R&D (research and development) projects, and intellectual property.

O. Belugin explained that the Maltese legal system is mixed: predominantly civil law, but with a noticeable influence of English law. He gave an example that the civil and commercial codes are similar in structure to the French codes of the Napoleonic period, while corporate and tax regulation has historically been based on old British acts. He also noted that certain provisions of the Maltese tax code are similar to those of Singapore, which was also based on the British model.

Moving on to the practice of starting a business, the speaker noted that a significant portion of Malta's GDP is related to foreign business activity, and the most common form for international clients is a limited liability company. He named the Maltese Business Register as the main institution for registering companies and emphasized that the vast majority of companies registered in Malta are similar to LLCs.

Among the key regulators, he named the MFSA, which issues licenses in the field of financial services. According to the speaker, if the documents are properly prepared, obtaining licenses is relatively predictable, and a license in Malta allows you to continue to use the European regime for providing services in other EU countries. He also mentioned the Malta Gaming Authority as the licensing authority for the gambling business. O. Belugin placed a separate emphasis on crypto regulation: Malta, according to him, was among the pioneers, and the experience gained influenced European approaches to regulating crypto asset markets.

Speaking about taxation, the speaker noted the existence of a network of double taxation avoidance agreements (approximately 70, including with Ukraine), and also mentioned the introduction of a transfer pricing regime in 2024 and the possibility of obtaining exemptions in certain cases. He described the corporate taxation system, where the base rate is 35%, but there are mechanisms for refunding paid amounts, which, under certain conditions, can reduce the effective tax burden. O. Belugin also mentioned the fiscal unit regime, the peculiarities of taxation of dividend payments, and, in terms of VAT, he separately focused on the specifics of online gambling. For individuals, he mentioned a progressive approach to income tax and an administrative model where the employer pays taxes on salaries, as well as a bunch of software incentives related to residency.

«This round table gave participants a practical overview of how the Maltese jurisdiction works for business — from company registration and licensing to tax incentives and compliance, - commented S. Lysenko on the event. - For the Committee, this is part of its systematic support for entrepreneurs entering EU markets. We will continue this series of meetings with practical case studies and answers to questions from advocates and clients».

Popular news

Guarantees of the practice of law

The UNBA presented a report on violations of advocates' rights in the TCC

The Committee for the protection of advocate's rights and guarantees of legal practice of the UNBA has prepared a consolidated report on violations of advocate's professional rights and guarantees of legal practice by territorial recruitment and social support centers for the period from 2022 to the first half of 2025.

Self-government

Statement by the UNBA Committee regarding manipulative journalistic material

Statement by the UNBA Committee on information policy and interaction with the media regarding manipulative journalistic material aimed at discrediting the advocacy institution.

Greetings

Congratulations on the anniversary of the establishment of the Ukrainian National Bar Association

November 17 marks the thirteenth anniversary of the establishment of the Ukrainian National Bar Association, a professional self-governing organization that has united advocates from all regions of the country into a single independent institution.

Guarantees of the practice of law

10 changes necessary for the implementation of the Convention on the protection of the profession of advocate

Most of the standards enshrined in the Convention on the protection of the profession of advocate have already been implemented in Ukrainian legislation. At the same time, in order to ensure a higher level of guarantees for the independence of advocacy, certain amendments should be made to the codes and the relevant law.

Guarantees of the practice of law

L. Izovitova: today advocacy maintains its independence and fights for guarantees for the profession

The Ukrainian advocacy remains an independent, constitutionally recognized institution of justice, which, in the conditions of war, has not only retained its subjectivity, but also consistently fights for guarantees to protect the profession.

Access to the profession

For candidates for the advocate: BCU has reminded them of the rules for crediting teaching experience

For the purposes of admission to the qualification exam, a candidate's work in scientific and teaching positions may be counted as experience in the field of law only if the position requires legal education.

Greetings

Young lawyers of the year named

The Ukrainian Young Lawyers Council honored lawyers who demonstrated the highest level of professional skill, responsibility, and dedication to their profession in 2024–2025.

Discussion

Urban Planning Code: what should the new rules for rebuilding Ukraine be?

Does Ukraine need separate codification in the field of urban planning, which model of law to choose, and how to ensure a balance between the interests of the state, communities, businesses, and citizens in the context of post-war reconstruction?

Publications

Censor.net Protecting advocates – protecting justice: addressing concerns about the new law

Ihor Kolesnykov A BRIEF SUMMARY REGARDING THE APPLICATION OF THE ORDER ON EXTENDED CONFISCATION IN LATVIA REGARDING FINANCIAL ASSETS OF…

Valentyn Gvozdiy WORKING IN A WAR ZONE

Lydia Izovitova Formula of perfection

Sergiy Vylkov Our judicial system is so built that courts do not trust advocates

Iryna Vasylyk Advocacy in the proclamation of Independence of Ukraine

Oleksandr DULSKY When we cross the border of the Supreme Anti-Corruption Court, we get into another department of the National Anti-Corruption…

Vadym Krasnyk The UNBA will work, and all obstacles and restrictions are only temporary inconveniences